Sharing the Future: AI, Inequality, and the Case for Universal Basic Capital

Maria Fonseca

Fri May 23 2025

As artificial intelligence (AI) continues to revolutionize the global economy, it presents both unprecedented opportunities and significant risks. Chief among these is the potential for AI to deepen existing wealth inequalities. While automation and machine learning promise increased efficiency and productivity, the benefits may disproportionately accrue to those who own the technology—corporations, elite investors, and a few knowledge-rich economies—leaving the rest of society behind.

This reflection examines the dangers of AI-induced inequality and explores how mechanisms like Universal Basic Capital (UBC) offer a more structural and just response than Universal Basic Income (UBI), drawing on arguments made by leading economists and publications such as Noema and the LSE Public Policy Review.

AI and the Engine of Inequality

In today's data-driven capitalism, power resides with those who own not just physical infrastructure, but intangible assets: algorithms, cloud platforms, data repositories, and intellectual property. The scalability of AI systems means that small labor forces can generate enormous profits, breaking the traditional link between productivity and employment and exacerbating inequality.

As Joseph Stiglitz notes, writing for “Noema” unless we change how capital is distributed, we risk reinforcing "a vicious cycle where inequality begets inequality." Ray Dalio similarly warns of a "new feudalism," where the concentration of wealth leads to political polarization and social unrest.

UBI: A Useful but Limited Tool

Universal Basic Income has gained traction as a response to automation, promising a no-strings-attached income to every citizen, providing a cushion as economies restructure. Studies have shown that UBI can reduce stress, improve well-being, and empower entrepreneurial activity.

However, UBI also has inherent limitations. It tends to treat the symptoms of inequality rather than its root causes. As Nathan Gardels argues, income transfers maintain consumption but do not alter economic power relations. UBI recipients remain consumers in a system where ownership and decision-making lie elsewhere.

Furthermore, UBI can be expensive, potentially inflationary, and politically contentious. Critics also note that it may undermine the value of purposeful work, offering subsistence without opportunity for growth.

UBC: Wealth from the Ground Up

Universal Basic Capital (UBC) presents a transformative approach to addressing economic inequality by shifting the focus from mere income redistribution to asset ownership. Instead of providing individuals with a regular income, UBC aims to grant citizens ownership stakes in productive assets—such as shares in businesses, data cooperatives, or public investment funds—thereby enabling them to benefit directly from the wealth generated in the economy.

Joseph Stiglitz, a prominent economist and Nobel laureate, has extensively discussed the structural issues underpinning economic disparities. He emphasizes that the current economic system often rewards rent-seeking behavior over productive contributions, leading to a concentration of wealth and power. Stiglitz advocates for reforms that promote shared prosperity, stating, "The only true and sustainable prosperity is shared prosperity" . This perspective aligns with the principles of UBC, which seeks to democratize capital ownership and ensure that economic growth benefits a broader segment of society.

Implementing UBC could involve mechanisms such as:

- Sovereign Wealth Funds: Governments could establish funds that invest in various sectors, distributing dividends to citizens.

- Tokenized Asset Ownership: Leveraging blockchain technology to allow fractional ownership of assets, making investment more accessible.

- Public-Private Partnerships: Collaborations where citizens hold equity in ventures developed using public resources or data.

By adopting such measures, UBC aims to rectify systemic imbalances and foster a more equitable economic landscape, resonating with Stiglitz's vision of a fairer and more inclusive society.

Case Studies

What experience do we have from moving theory to practice?

Universal Basic Income in practice: Finland’s national pilot (2017-2018)

One of the most closely watched implementations of UBI was Finland’s two-year experiment. Two thousand unemployed people were randomly chosen to receive €560 a month, unconditionally replacing their unemployment benefit. The headline results were mixed. Employment outcomes were statistically indistinguishable from those of a control group, but participants “were clearly happier, less stressed and more confident about the future,” according to the first government evaluation. Interview data collected by the Social Insurance Institution (Kela) echoed the quantitative findings: the stipend gave recipients room to plan, study or volunteer, yet did not by itself generate new jobs.

The Finnish experience therefore confirmed both the promise and the limits of UBI: psychological security improves, yet the underlying distribution of wealth—and with it the power to shape the digital economy—remains unchanged.

Seven years on, let’s imagine Ella, a former retail manager displaced by the recent phenomenon of AI-driven automation. She is given a monthly sum of £1,000. Initially felt liberating: it paid the rent, financed on-line retraining and bought time for community volunteering. Three years later, however, inflation had eroded its real value. With no assets to appreciate, Ella was still precarious. The income floor preserved dignity, but it did not create a ladder into ownership or influence in an economy dominated by capital-intensive AI firms.

Universal Basic Capital in practice: Alaska’s Permanent Fund Dividend

If Finland illustrates the logic of a basic income, Alaska offers the longest-running demonstration of a basic capital endowment. Since 1982 every resident has received an annual dividend drawn from a constitutionally protected sovereign wealth fund that invests a share of the state’s oil revenues. In 2023 the payment was $1,312, and legislators agreed a provisional $1,655 for 2024. Over four decades the Fund has grown to more than $75 billion, transforming a non-renewable resource into a renewable pool of financial assets.

Independent studies show that the dividend has cut Alaskan poverty by 20–40 percent overall—an effect strongest among rural Indigenous communities, children and seniors. Crucially, the payment stems from collective ownership of a productive asset, so every resident receives not just income but a small, perpetually compounding stake in the state’s natural-resource wealth. Researchers also find no lasting reduction in labour-force participation; at most, the dividend correlates with a modest rise in part-time work, suggesting cash injections stimulate local demand rather than encourage idleness.

Yet the Alaskan model also exposes design challenges. Because the dividend must compete with schools, infrastructure and health care for limited oil revenue, annual political fights over its size can paralyse other budget priorities And while the payment reduces poverty, its flat structure is not progressive: affluent households receive exactly the same amount as the poor. Even so, the programme remains a rare proof-of-concept that asset-based redistribution can deliver material and psychological benefits at population scale.

Let’s again imagine Malik, a 29-year-old gig worker who moves to Anchorage, and experiences the dividend much as he would a pilot UBC endowment. The lump-sum arrives each October; he routinely channels part of it into an index-tracking fund through the state’s Pick-Click-Give programme, slowly building financial assets that yield dividends of their own. The cheque does not replace work—it supplements income, buffers seasonal fluctuations and, by tying his fortune to the Fund’s performance, makes him a long-term stakeholder in Alaska’s post-petroleum transition.

If we contrast both examples we can see how Finland’s UBI pilot shows how unconditional income enhances well-being but leaves structural inequality intact; Alaska’s dividend (a kind of UBC) shows how a universal share in productive assets can shrink poverty while building participatory ownership. Together they suggest that a humane AI transition may require both security and stakeholding—but that only capital grants, not cash alone, change who actually owns the future.

How UBC Can Work

UBC implementation can take several forms:

- AI Sovereign Wealth Funds: Governments can tax super-profitable AI firms and redirect revenues into public investment funds, distributing dividends to citizens.

- Tokenized Asset Ownership: Blockchain technologies enable fractional ownership of digital and physical assets, allowing capital to be distributed fairly and transparently.

- Public-Private Platforms: Governments and firms can co-develop platforms where citizens hold equity in AI systems trained on public data.

- Civic Education: Financial literacy programs ensure recipients understand and can manage their capital holdings responsibly.

As discussed in Noema, such approaches could democratize access to capital and ensure that the benefits of AI are broadly shared.

Drawbacks and Limitations of UBI and UBC

Notwithstanding its promises, both UBI and UBC have trade-offs:

UBI challenges include:

- Cost: Universal disbursements are fiscally massive and may require significant tax reforms or cuts to other services.

- Inflation Risk: Boosting demand without increasing supply could erode real value.

- Work Incentives: Critics warn that unconditional income may reduce motivation to work or contribute.

- Uniformity vs. Need: Giving the same to everyone may seem fair but can divert funds from those in greatest need.

On the other hand UBC challenges include:

- Implementation Complexity: Requires sophisticated infrastructure for asset distribution, governance, and regulation.

- Volatility: Asset markets can fluctuate, exposing citizens to financial risks.

- Financial Literacy Gap: Without strong education, individuals may mismanage or squander assets.

- Access Inequities: Even with equal distributions, differences in personal networks or information access can perpetuate disparities.

A Future Worth Sharing

Drawing on Professor Sir Julian Le Grand study “A Springboard for New Citizens” , UBC could be a much needed option for wealth distribution. We would need to look at it not merely as a financial intervention— but a civic institution. The authors propose a symbolic Citizen's Day, where every young adult would receive their capital endowment as a rite of passage.

This day would mark more than economic inclusion—it would affirm social belonging and democratic agency. By giving citizens a literal and symbolic stake in national wealth, it redefines what it means to participate in a society shaped by AI. This reframing helps us move beyond welfare logic toward a more inclusive form of economic citizenship.

As AI redefines value creation, we must redefine how that value is shared. UBI can provide a dignified floor—but UBC builds a ladder to prosperity, participation, and ownership. UBI reduces precarity; UBC enables flourishing.

The civic vision presented in “A Springboard for New Citizens” challenges us to think not just as economists or technocrats, but as citizens of a shared future. By granting each new generation a stake in society's productive assets, we affirm not only equality, but belonging.

The AI age need not be an era of exclusion. With visionary policies like UBC, we can build a future where the wealth of machines uplifts humanity—and where every citizen, from Ella to Malik, holds a piece of tomorrow.

previous

What Makes You Resilient: The Quiet Strength That Lives Within

next

Rare Colours: A Journey into the Extraordinary Spectrum of Wonder

Share this

Maria Fonseca

Maria Fonseca is an interdisciplinary educator, writer, artist and researcher whose work bridges the realms of academic knowledge, community engagement, and spiritual inquiry. With a background in Fine Art and a doctorate in creative practice, Maria has spent over a decade exploring the intersections of human experience, cultural meaning, and collective transformation.

More Articles

Unpacking The Science Behind Social Media Algorithms: How They Shape Your Online Experience

The Importance and Implications of Rhythm in Nature: Unveiling Earth's Rhythmic Symphony

Understanding The Attachment Theory: Its Impact from Infancy to Adulthood

Elder Voices of the Millennium: Ai Weiwei

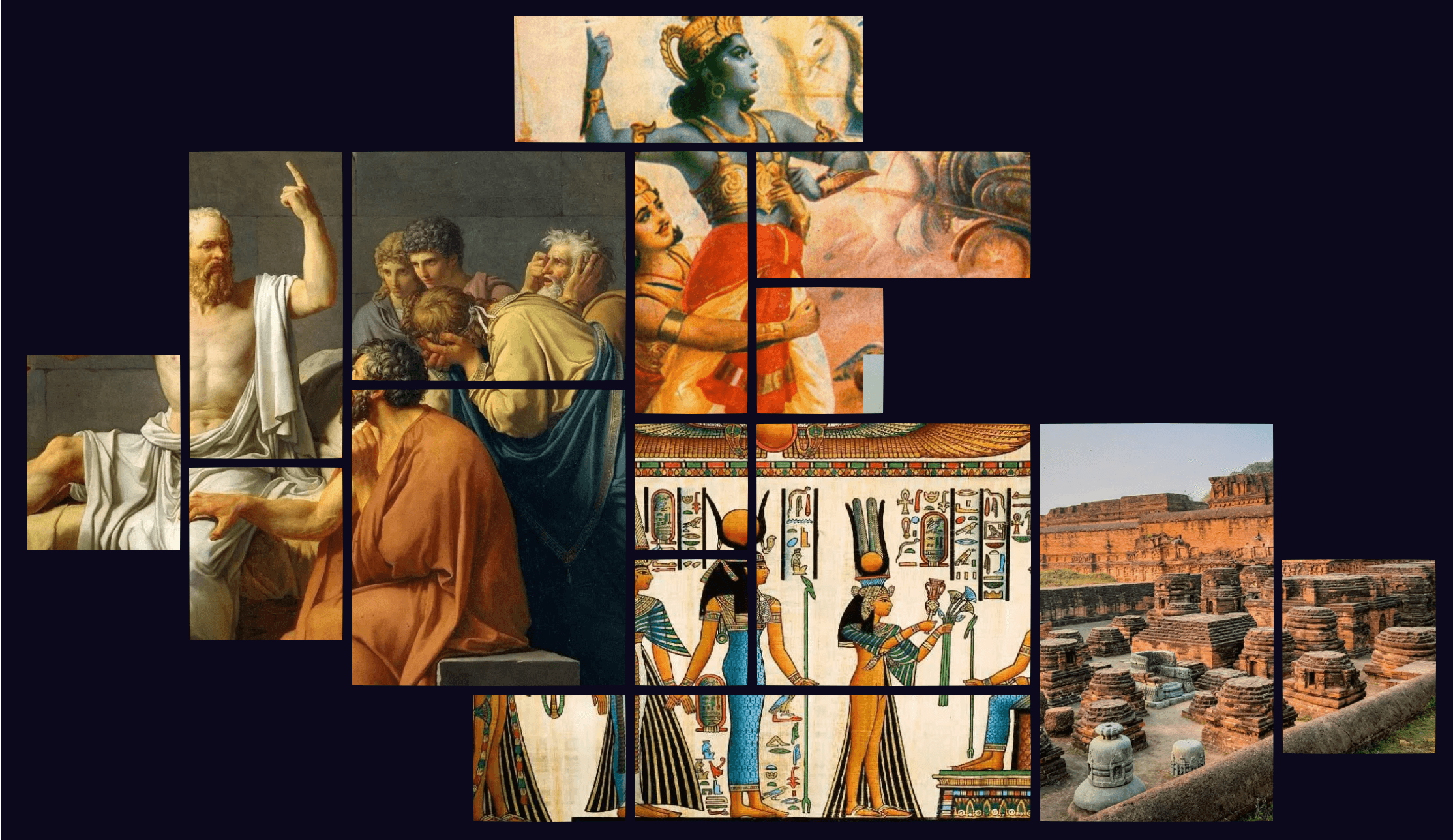

How Ancient Teachings Offer Timeless Wisdom for Navigating Modern Life